You might have noticed the recent buzz around Bitcoin's potential drop to $75,000. Experts are sounding alarms due to a mix of technical signals and macroeconomic pressures. The formation of a head-and-shoulders pattern, combined with a strong U.S. dollar, hints at possible instability ahead. As market dynamics shift, understanding these factors could be crucial. What does this mean for your strategy?

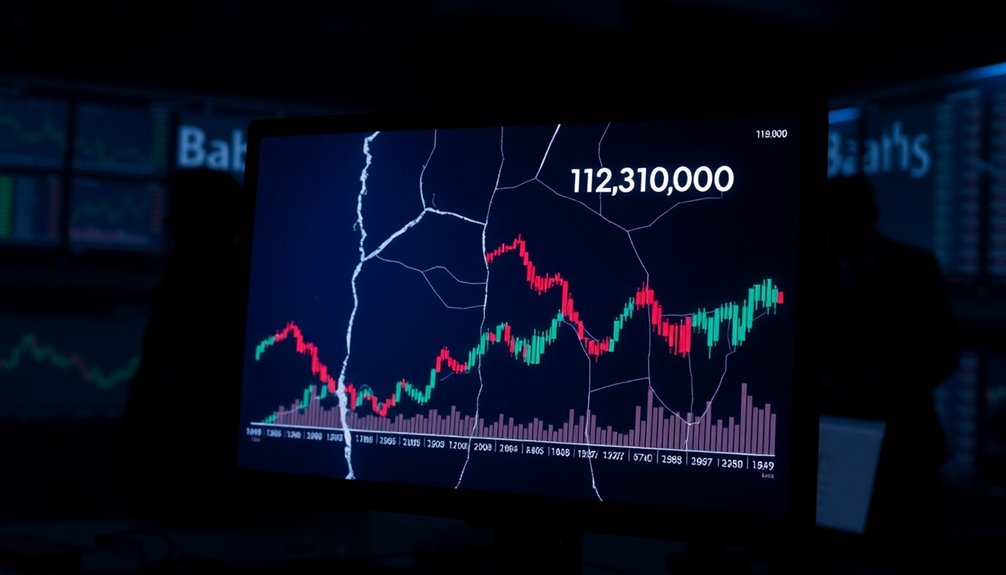

As Bitcoin continues to navigate a volatile market, analysts are closely watching for signs of a potential drop to $75,000. Recent technical analysis suggests a head-and-shoulders pattern forming, which could indicate a bearish reversal. If this pattern holds, it might lead to significant price corrections, aligning with predictions from experts who see a potential dip to that psychological level.

One crucial factor in this situation is the CME Bitcoin futures gap that exists near $75,000. Gaps of this nature often prompt price corrections as traders look to fill them, adding to the pressure on Bitcoin's current price. Additionally, Fibonacci levels play a role in understanding support and resistance points. If Bitcoin approaches these Fibonacci retracement levels, you might want to keep a close eye on how it reacts. Moreover, the security risks associated with online transactions can affect trading behavior and market confidence.

Market conditions are equally vital to consider. The contraction of liquidity due to central banks' monetary policies can exert downward pressure on Bitcoin. With a strong U.S. dollar and shifting interest rates, Bitcoin could face additional headwinds. Also, reduced Tether supply creates further uncertainty, which may influence investor sentiment. In such a climate, macroeconomic factors can significantly impact Bitcoin's short-term performance. Notably, nearly $1 trillion in nominal liquidity has been drained from the market recently, which adds to the overall uncertainty.

Experts like Arthur Hayes and Joe McCann are raising red flags, warning of a potential slip to $75,000. They cite both technical and macroeconomic factors as reasons for concern. However, it's worth noting that despite these short-term bearish signals, many in the industry remain optimistic about Bitcoin's long-term potential. Historical data reveal that Bitcoin frequently undergoes corrections before embarking on major rallies, so it's essential to keep that context in mind.

The market dynamics suggest a possible shift from bullish to bearish trends, and you may need to adjust your strategies accordingly. Pay attention to key support levels like $103,393 and $100,557. If Bitcoin breaks through these points, it may signal deeper trouble ahead. Conversely, resistance levels around $107,000 to $108,000 could act as a barrier against any upward movement.

As an investor, being tactical and prepared for market instability is crucial. Familiarize yourself with these signals and prepare for potential volatility. Whether you're a long-term holder or a trader, understanding these factors will help you navigate Bitcoin's unpredictable waters.